To some, perspective and context are a complete bitch. And the reason is simple: it levels the playing field. When utilized during a political argument, it can push one of the combatants over the edge; you know, with them making shit up wildly.

For example, within the last year a co-worker from another job and I got into a heated discussion about the LGBTQ community. I am all for everyone living their lives, and she was a die-hard Christian who flat-out said that "any and all pro-LGBTQ community books/teachings would lead to a lot more pedophiles."

I pounced.

"OK, since you seem to know what's going on, give me one example from one book or lesson you say is being taught that would promote this."

She couldn't.

Eventually, it got to where she yelled and walked away yammering on about "the end of days." I increased her perspective by showing how little she actually knew, causing her house of cards to crumble.

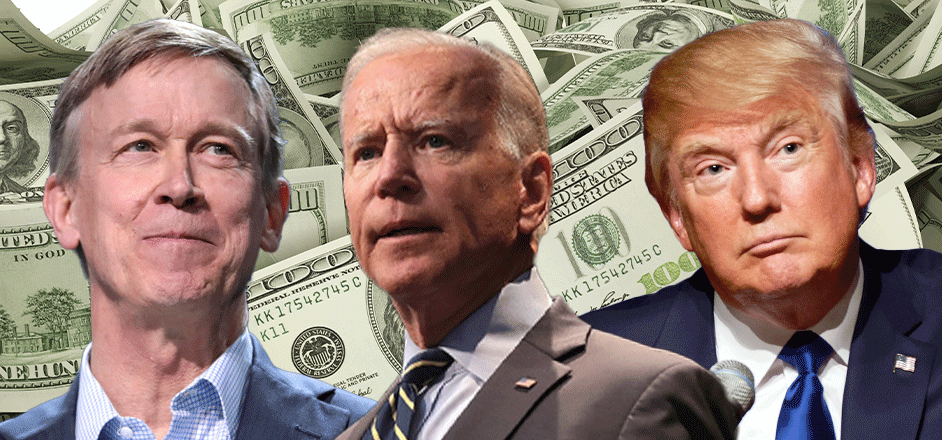

Though equality under various (in this case financial) laws has been written about ad nauseam, due to events occurring during the Biden administration, I wanted to shift the perspective a little.

I believe we do have equality under the law. However, the reality is that this equality pertains to those who share a tax/influence/power bracket. And though I will eventually snake my way to both the current and former President, I think one of the best examples of this "equality" comes from our own backyard.

You see, there are some laws that do eventually end up in some form of penalty when broken, no matter the political influence of the offender. A good example of both what these penalties look like for the powerful, along with how these manipulations are completely bipartisan, comes in the form of Colorado’s own congressional representatives violating the Stop Trading on Congressional Knowledge Act, or STOCK Act, passed in 2012.

In 2022 Republican Representative Doug Lamborn and his wife were late in disclosing stock they traded that was worth between $68,000 and $120,000 in NetApp, a data management company. And in 2021, Democrat Senator John Hickenlooper was late disclosing stock purchases by his wife that were worth as much as $1.2 million. Sorry John, but if you make any more claims that you've "never had a scandal while in office," the readers of this article will know you're lying out of your ass

As I mentioned previously, there is a fine. And since these individuals have the ability to directly impact their stock prices via the legislative process, you'd think it would be a fairly substantial amount.

If found in violation, they could be fined $200. Also, this number can be increased if the person is a repeat violator like Hickenlooper; then the fines can reach as much as a bank-breaking $500. Subsequently, the accused can also apply for a waiver–which does get approved more than it should.

In related news, my wife and I got a letter from the IRS a few months ago stating that we were under audit due to an unpaid state tax in the amount of $260. In the letter, we were informed that failure to comply could result in a massive fine that would increase due to interest compiling, as well as potential jail time. It goes without saying that we don't make a combined salary of seven figures or more per year.

One thing we mustn't forget is that whenever you engage in crooked activities, the whole process becomes so much easier when you have an accomplice. And what better place to find one than in the White House?

If you've been following what Biden has been doing in regard to the IRS over the last year or so, then the audit really shouldn't come as a surprise. The President has repeatedly tried to mislead the public about his dangerous IRS expansion via White House press secretary Karine Jean-Pierre claiming "the IRS expansion plan is not about folks who make less than $400,000." And that the expansion was to "close loopholes" and make the wealthy "pay their fair share."

This is a lie.

Analysis from the nonpartisan Congressional Budget Office confirmed at least $20 billion of the revenue Democrats hope to collect from taxpayers will come from lower- and middle-income earners and small businesses.

But this wasn't enough. Enter the "billionaires tax" …

During his State of the Union speech earlier this year, Biden made his intentions clear. "Pass my proposal for a billionaire minimum tax," he told Congress. "Because no billionaire should pay a lower tax rate than a school teacher or firefighter." Though I agree with the sentiment wholeheartedly, when you pick through the details, you find the potential for a one-way trip to Disney-Hell.

Rather than simply raising tax rates, it effectively taxes wealth, including unsold stocks, bonds, and real estate. The billionaire minimum tax would require households with total net wealth over $100 million to pay a minimum effective tax rate of 20% on an expanded measure of income that includes unrealized capital gains. This means that if a tech founder owns $1 billion in stock and the stock increases in value to $1.5 billion during the year, they would owe a tax of up to $100 million on the $500 million paper gain–even if they didn't sell a single share.

Sounds great, right? Of course, as with anything brought forth from the minds of politicians, it is filled with grotesque loopholes.

You see, taxing unrealized gains is increasingly complicated with today's wealthy–most of whom have fortunes tied to volatile tech stocks that swing wildly from year to year. Using this knowledge, let's look at Elon Musk as an example of this plan in action.

If the billionaire minimum tax started in 2020, he would have owed a tax of $31 billion on his total net worth, which at the start of the year was $156 billion. In 2021, his net worth increased by $121 billion, so he would owe $24 billion in taxes for the year. In 2022, however, his net worth fell by $115 billion on Tesla's stock decline. If he already paid the 2021 tax, he will have paid billions of taxes on wealth that he no longer has. The government would then have to send him a $23 billion refund check.

Yes, based on speculation, the government could end up giving Musk tens of billions of dollars.

It's stunning that Biden would allow such a loophole given the revelations of chicanery brought about by the release of ex-President Donald Trump's tax returns.

In the summary prepared by the Joint Committee on Taxation, it was found that Trump declared negative income in 2015, 2016, 2017, and 2020. These losses were able to be carried over year after year. Because of this, he paid a total of $1,500 in income taxes for the years 2016 and 2017.

On a personal note, this means I paid more in taxes during those years than the President of the United States did. You probably did too.

If all of this maneuvering of our financial systems has a familiar feel to it, it should. In the United States of America–during the year 2023 and the foreseeable future–our system for attaining wealth works exactly like the same crooked method utilized by the main characters of the Mel Brooks film "The Producers." In other words, to obtain the levels of wealth you’ve only dreamed of, you have to lose as much money as humanly possible.

Jesus Christ, common core math makes more sense than this …

Leave a Reply

You must be logged in to post a comment.