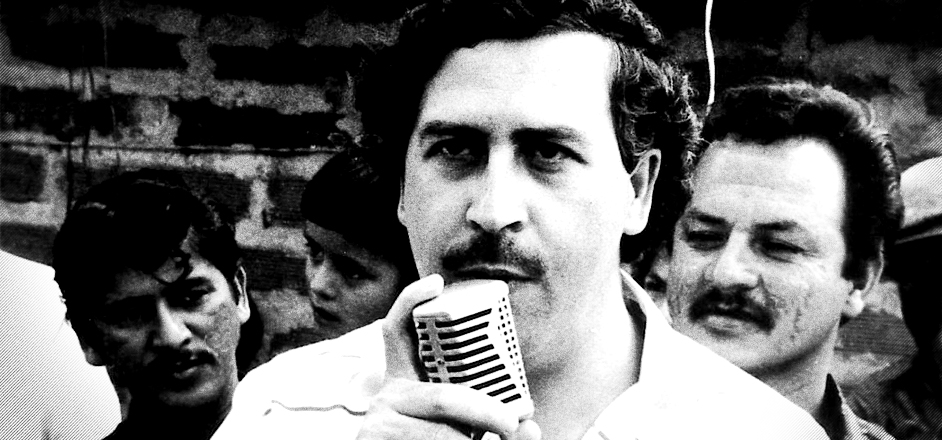

Operating outside the margins while claiming to be a champion of the people was the go-to strategy for revenue generation and basic survival for the Medellin Crime Cartel for decades. The violent group, ruthlessly run by the late Pablo Escobar, saturated the United States with cocaine and other illicit activities for years, and left a wake of murdered bodies and lives destroyed in the process.

It was a perverted Robin Hood-esque advocacy for the poor, working class of Colombia.

Yet even after the high-profile killing of Escobar in 1993, the family is still growing branches from its firm Colombian roots. Only now, instead of (or maybe as a supplement to) lowfi drug-smuggling, the Escobars are going high tech — his brother, Roberto, says he is starting a cryptocurrency.

What could possibly go wrong?

Much of the Cartel’s success came from the fact Pablo ran the organization with an iron-fisted efficiency of a typical Wall Street CEO. That strategy included hiring his brother, Roberto De Jesús Escobar Gaviria — better known as Roberto Escobar — as the Medellin organization’s accountant (you see, nepotism in crime families isn’t exclusive to the White House).

When things fell apart and Pablo was killed, Roberto (nicknamed El Osito, “Little Bear”) was convicted and served over a decade in prison. Since his release, Little Bear has made several attempts to continue to operate outside legal margins while employing techniques that are absolutely within legal, or at least “non-illegal,” boundaries. In basic black and white, he’s still a criminal, with only one shade of gray — maximizing profits at the expense of anyone else.

Roberto’s most recent venture into the murky world of cryptocurrency is just as sketchy as the cocaine trade, says experts in the field. “Cryptocurrency is like the wild west gold rush of the mid-1800’s or the golden DotCom rush of the late-1900’s … except there is no gold,” says Peter Moreno, former officer in the U.S. Marine Corps who spent years in Colombia as part of a U.S. mission to combat cartels. He's also a Columbia University MBA, former investment advisor and is currently a financial crimes writer. “It’s a classic speculative bubble, people want to get rich quick, and the fact that regulators are still scratching their heads wondering, ‘How in the fuck do we regulate this?’ means it’s a lawless petri dish ripe for breeding all kinds of nefarious activities.”

Some cryptocurrencies have been able to achieve a level of success with an enticing hook. For dietbitcoin (DDX) — the name of Escobar's venture — that outrageous hook is the family name and the association with one of the most notorious crime families in recent history. “I think [Roberto’s] definitely capitalizing on the allure of his name. It’s kind of a twisted prestige to be associated with Escobar’s coin,” says Moreno. “But I also think he’s doing it as a way to legitimize the Escobar name. In the Latino culture, name legacy and legitimacy is the most valuable currency of all.”

But the outrageousness of the whole seedy set-up doesn’t stop there. According to the leading cryptocurrency resource Cointelegraph.com, in a White Paper written by Escobar (in first person) he claims to be the first person "to publicly come out and claim that bitcoin was created by the American government." He adds that "the world is going to wake up … to see that this was created by them. And when they see it, it is too late, and when the CIA [finds] out that the world knows about this, the CIA is going to sell all of their coins, and they will destroy the value of bitcoin." Roberto implores buyers to buy in to the idea that DDX is the best response to this kind of impending disaster.

Escobar doesn’t explain the motivation for the CIA to dream up cryptocurrency or the motivation for the CIA to financially ruin lazy investors across the globe — nor has he detailed how he even knows the CIA is behind bitcoin.

“It’s a scam, through and through,” says Moreno. “Even the name, dietbitcoin? What in the hell is that? Like Diet Coke? He couldn’t even think of something original,” Moreno says with incredulity.

“But here’s why it’s a scam,” he continues, “the initial ICO (Initial Coin Offering, similar to an IPO) is $2 per coin, then it quickly jumps up to $1000 a coin in following offers. I’d be willing to bet no one gets in on the $2 offering BECAUSE IT DOESN’T EXIST!” Moreno explains.

“Additionally, cryptocurrency has no valuation standard, so it can be worth $1000 today, $5000 tomorrow, and $1 the following day. The value isn’t based on anything concrete — not on physical company assets, not on revenue potential, not even on human capital. It’s based on hopes and dreams. It’s a fairy tale.” One can hear Moreno’s eyes roll as he says this.

Cryptocurrencies are digital currencies whereby encryption techniques are used to generate and limit the supply of units. The currencies operate independently from banks and the dollar standard. They’ve become the anti-establishment currency of a generation of disenfranchised global investors who are weary and suspicious of government supplied and controlled currency. The anti-establishment establishment platform is a perfect storm of opportunity for the Escobar family’s traditional and self-appointed "Champion of the People" brand.

“The problem with it is, it doesn’t really get you anything,” Moreno continues. “Currency is only valuable if it is a tool to obtain things. Cryptocurrency is just valued on the demand of cryptocurrency. For the most part, people are buying nothing.”

This isn’t the first time Escobar has tried to use “non-illegal” methods to maintain his fortune. In 2014, he co-founded Escobar Inc., a venture capital and investment company who’s investment capital stemmed from decades of illegal drug trafficking. In 2016, he attempted to extort $1 billion from Netflix for “unauthorized content usage” in its series, Narcos.

It remains to be seen whether dietbitcoin will legitimize Escobar’s business ventures and whether the cryptocurrency market will even embrace it. For now, cryptocurrency investors are taking a cautiously optimistic attitude on the capital potential overall.

Traditional market investors are more unconvinced than ever.

“Basically, the whole thing,” says Moreno, ”it’s a fuck-story.”

Leave a Reply

You must be logged in to post a comment.